A Model to Assist Sales in Answering Key Questions when Incorporating a PreSales Organization

As presales professionals, we are ultimately responsible for our sales organizations and how we interact with sales to achieve revenue goals. As presales and sales leaders there are many questions that we need to answer when developing and building our teams.

Many times, when we are looking for additional advice from our peers we will reach out on LinkedIn or post questions on presales community boards like the PreSales Collective . Almost every time I see these questions the first response from other presales leaders is “it depends”. This is because a lot of these questions that are posted are related to a topic that is more complex in nature. The challenge in the world of presales is the role is extremely dynamic from organization to organization. Therefore, a simple one-dimensional answer will work for some but not for most.

What I have tried to do is build a framework or model in which to run these questions through to try and better understand the dynamic nature of the presales industry and provide guidance on making better decisions when building our teams.

PreSales Questions

The common presales questions can be answered by leveraging the matrix, so what are these questions? The below list is an example of some of the more common questions asked of presales leadership as they design their teams to support sales in the organization’s overall sales strategy. This by no means is a complete list and hopefully can provide insight into the concept.

Sales engineer target hiring goals

- Presale experience Industry

- technology expertise

Target hiring goals identify the experience and skill sets needed by the sales engineer to support the sales effort with the goal of achieving technical validation from the customer. Years of experience and industry expertise are the key elements in looking for the right sales engineer.

Sales engineer on-target earnings

- Base compensation

- Variable compensation

One of the big challenges in hiring sales engineers is the wide range of on-target earnings potential. I have seen on-target earnings shy of six figures, all the way up to $400,000 plus, depending heavily on industry expertise and experience.

Sales Engineer To Account Executive Ratios

The common presales questions can be answered by leveraging the matrix, so what are these questions? The below list is an example of some of the more common questions asked of presales leadership as they design their teams to support sales in the organization’s overall sales strategy. This by no means is a complete list and hopefully can provide insight into the concept.

Sales engineer target hiring goals

- Presale experience Industry

- technology expertise

Target hiring goals identify the experience and skill sets needed by the sales engineer to support the sales effort with the goal of achieving technical validation from the customer. Years of experience and industry expertise are the key elements in looking for the right sales engineer.

Sales engineer on-target earnings

- Base compensation

- Variable compensation

One of the big challenges in hiring sales engineers is the wide range of on-target earnings potential. I have seen on-target earnings shy of six figures, all the way up to $400,000 plus, depending heavily on industry expertise and experience.

Sales engineer to account executive ratios

This defines how many account executives a sales engineer can support. I have seen a wide range of models from one to one to pooling and everything in between.

Sales engineer specialist or overlays

To achieve a technical validation approval do we need to engage a sales engineering specialists as part of the selling team?

Technical validation motions like POCs, POVs, workshops, pilots or product lead growth potential

- Technical validation cost

- Technical validation duration

Technical validation motions are driven by the customer and are the major objectives of the presales engineer in keeping the sales motion moving towards an opportunity close. There is great debate over whether technical validation is required in sales cycles. Let me make this clear. It is the customer who drives the demand for technical validation. The more complex the technical validation process, the longer the sales cycle and the higher the cost of sale in an attempt to achieve the technical win.

Depth of discovery

Discovery is the process in which sales engineers determine what the customer needs to observe in the technical validation process in order to achieve solution approval. Your solution does solve my problem, often termed a technical win. In addition, prerequisites required to achieve technical validation should be thoroughly investigated prior to starting the technical validation process.

Discovery is an important step in the process. However, it is not the only step in the process. I have seen discovery be used in ways where it becomes the number one sales inhibitor keeping sales opportunities moving in a positive direction. Discovery is different than sales qualification which is the primary responsibility of the selling team member or account executive. Keep your discovery focused and as simple as possible to meet your objectives.

Sales engineering post-sales or delivery involvement

Post sales or the deployment of the solution after the opportunity is closed is currently another contentious debate amongst the presale’s community. As I have previously written about, What is “Presales”? – Part I, you need to be very careful when and how you leverage presales sellers to do post sales work.

Demonstration Possibilities

Here is another topic with a great deal of debate. Should sales use an automated demo solution? Do I use a canned demo or a custom demo and when? Should I use a demo environment or live environment? What types of demos do I need to be able to deliver and when?

Google “demo types” and you will see the confusing variety of responses primarily due to demo vendor influences. There are many options and questions around the demo topic. Many of these answers depend on where you are in the sales cycle, who you are selling to and how complex is your industry and technology?

Presales Matrix Framework

Many times, when we are looking for additional advice from our peers we will reach out on LinkedIn or post questions on presales community boards like the PreSales Collective . Almost every time I see these questions the first response from other presales leaders is “it depends”. This is because a lot of these questions that are posted are related to a topic that is more complex in nature. The challenge in the world of presales is the role is extremely dynamic from organization to organization. Therefore, a simple one-dimensional answer will work for some but not for most.

What I have tried to do is build a framework or model in which to run these questions through to try and better understand the dynamic nature of the presales industry and provide guidance on making better decisions when building our teams.

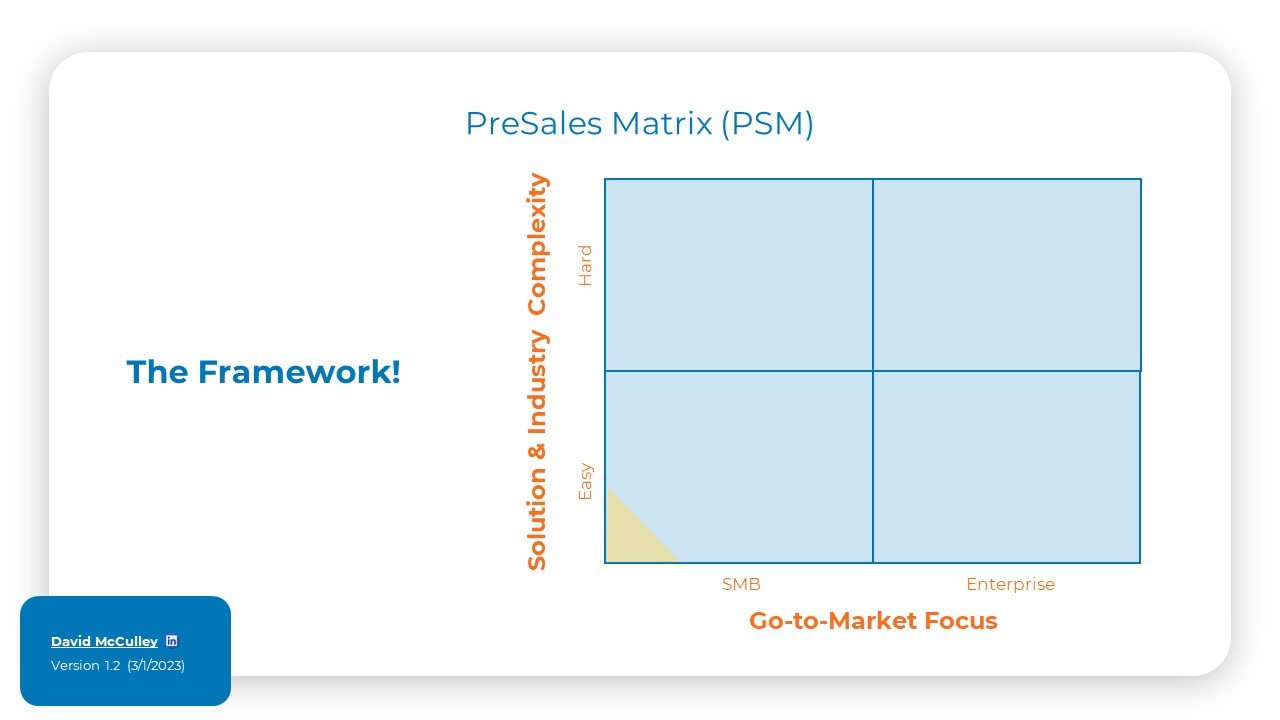

What you see above is a four-quadrant matrix to help better answer these questions or that follow up statement “it depends” is based on two key elements.

The horizontal axis aims primarily on the go-to-market focus which basically is the size of the organization we are targeting to sell to. As I stated above, for those early-stage companies you really want to focus your ideal customer profile (ICP) on a single quadrant. For the large enterprises you will find the presales teams will be broken into a management structure to support these individual quadrants. If not, you may find a need to restructure your presales teams.

The vertical axis focuses on solution and industry complexity. For example, I would put cyber security technology and SAAS security solutions extremely high on the axis. These types of sales engineers are typically in high demand due to supply challenges. On the lower end, you will find more simple technologies like document signing and sharing in other more simplistic technologies that are easy to learn and don’t require extensive experience to articulate its value. This lower level is usually where new sales engineer can break into the career.

Word of caution. Transitioning into presales as a sales engineer or solutions consultant is not an easy one. As you will see in the framework there is a small opening of opportunities for inexperienced presales individuals lacking any type of industry expertise. This is identified by the yellow shading in the bottom left quadrant in the above image. The market is currently flooded with applicants at this level for a variety of reasons and you will find little opportunity and a lot of competition. If you have industry expertise you will have a slight advantage. However, you will find competition with experienced presales candidates. I provide this knowledge to temper expectations and have historically shared it with the individuals I have mentored aspiring to be future sales engineers.

Go-to-Market Focus

The go-to-market focus is really about understanding and zoning in on your ICP. In early-stage companies you may have one or two go-to-market strategies. If not, I highly recommend you narrow your ICP down to a very focused and direct strategy. For large enterprise companies you will quickly find out that there is not one single answer to solve the problem across the organization. This is why it is ideal to break your presales teams up into go-to-market presales teams such as:

- Federal – DOD/Intel

- Federal – Civilian

- Named accounts

- Large enterprise

- Midmarket

- SLED(State local and education)

- SMB (Small-to-midsized business)

Depending on your solution offering you may also have vertical specific teams like carrier and medical, for example.

This way the presales managers of each of these go-to-market strategies can answer the question that will best meet the needs of their specific team. Simply put, you’re going to have different answers based on the different go-to-market strategies.

Additional Factors

Remember this is a framework providing guidance on decision making pertaining to complex presales questions. In unique situations there could be other factors that need to be taken into consideration and like everything else in presales there is no constant. Understanding the presales environment means you must embrace change, and change is the one constant in presales.

There are additional factors that can impact decision making that one needs to be aware of. One potentially big factor that I focus on is sales leadership style and personality. Although this will have an impact on decision making, it is not the foundation for answering questions when building an organization.

For some large organizations you may have to even zoom in tighter as shown below in Image-2. If you find some of your strategies are not living up to your expectations a tighter zoomed in focus may be required to plot your answers and provide guidance on your organizational strategy.

So, a little advice when submitting questions to the presales community. When formulating that question it would be extremely beneficial to the community if you outline your go-to-market targets and what kind of solution you’re selling and the complexities you are facing.

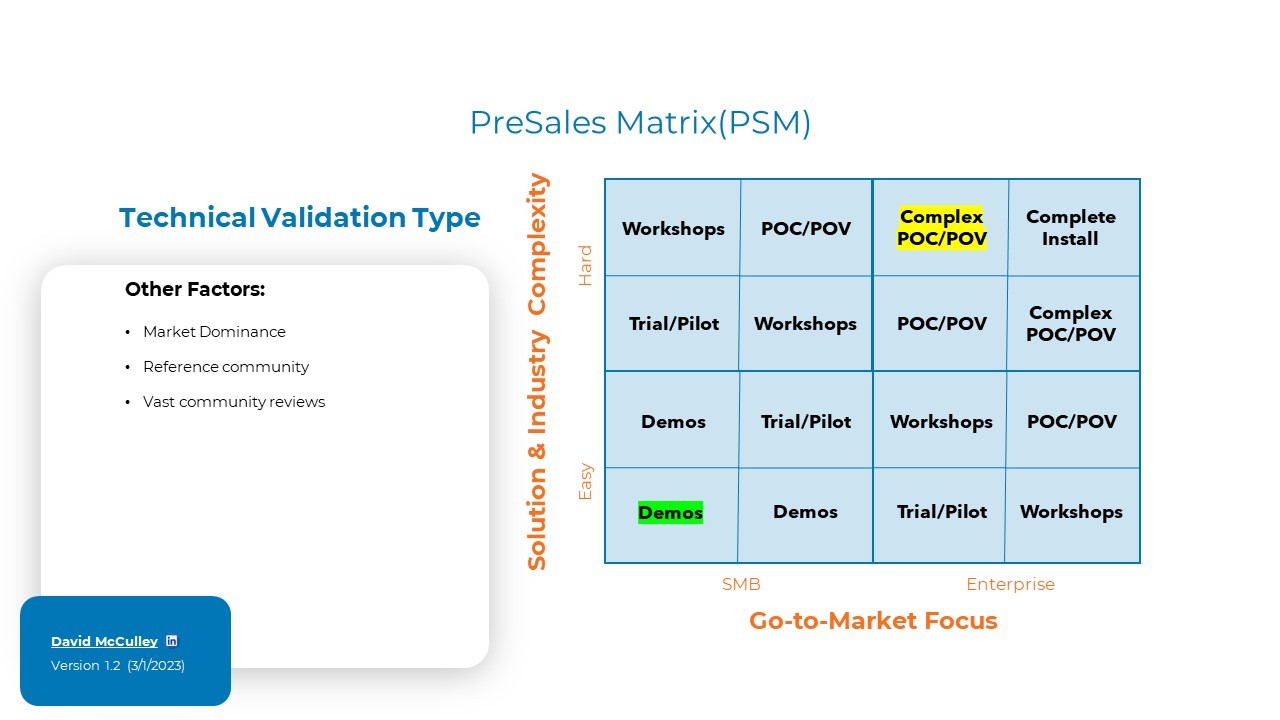

Putting the PSM to the Test – Technical Validation Type

Let’s apply a few questions to the Matrix. The first example is the technical validation model. I have seen this question asked and answered repeatedly for decades. As I have outlined it is not a simple question. If a quick response is provided it is usually in the context in which the responder is actively operating.

Let’s say I work for a newly emerging cyber security company. It’s a new malware interception technology and I have a highly interested enterprise customer. Where does it fall on the chart? You are probably looking at a Complex POC/POV highlighted in yellow in Image-3 below. Looking at other factors like you are a start-up and reference customers and market dominance is most likely not in play. As an emerging technology I would concentrate on a small set of ICP’s as it pertains to the go-to-market focus. As a small emerging company, having multiple technical validation programs can be very costly to staff and maintain.

In my second example I applied our company to an SMB market highlighted in green which is demo only. Why would we invest a lengthy POC to a small SMB deal knowing it will take the same amount of time and activity to complete as an enterprise deal? It comes down to the technical validation opportunity cost.

As the company grows and achieves market dominance and has a larger reference community, I will be able to defer the complex POC/POV in my down-market opportunities. Most of my very large enterprises and federal opportunities will still require a POC/POV of some type. The reality is most companies have historically bought technology solutions without doing an evaluation only to find out the solution fell short of its promises.

Burn me once shame on you, burn my twice shame on me.

So, the buying community demands a technical validation process of some type. The larger the opportunity the larger the technical validation process. Obviously, renewals and expansion opportunities do not fall in the category unless new technology is introduced.

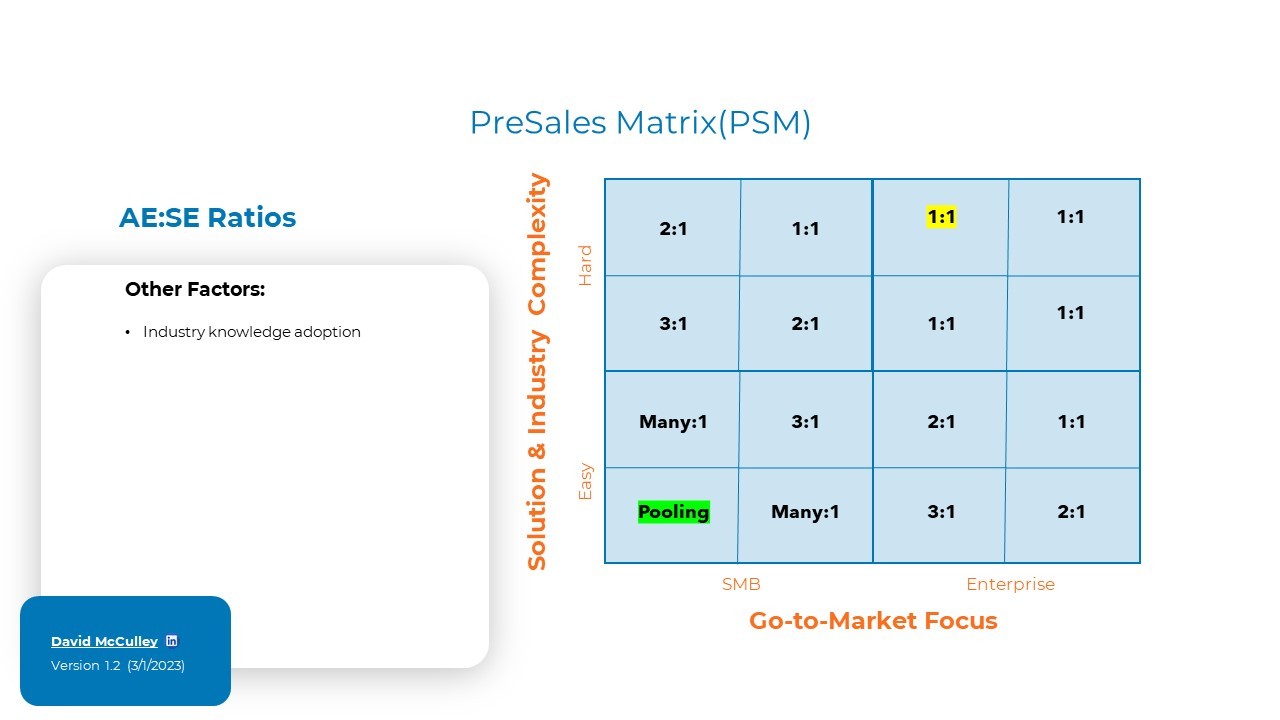

Putting the PSM to the Test – Sales Engineer (SE) to Account Executive (AE) Ratios

For this model, we look at two organizations. The first is the emerging cyber security outlined in the first example. Due to the complexity of the customer and technology I would recommend a 1:1 ratio. Complex technical validation with complex solutions would be difficult to sustain supporting more than one account executive as highlighted in yellow in the below Image-4. The true number can be calculated by understanding the point of diminishing return for SE to AE ratios. This is the number of opportunities an average sales engineer can manage with success. If the sales engineer takes on one more opportunity all will deteriorate.

See “Account Executive (AE) to Sales Engineer (SE) Team Ratios” for more information on this topic.

The second opportunity we will discuss is a document sharing company I outlined above. With this solution the complexity of technology is fairly simple and if the selling team is working down-market or the SMB go-to-market quadrant, pooling is a viable option. This is highlighted in green in the above Image-4.

For those of you unfamiliar with pooling, it’s a scenario where there is an SE pool and as account executives require a sales engineer, they request one. Then, one of a number of sales engineers in the pool will be assigned. Due to the minimal requirements on the sales engineer, this model can work. The risk is a lack of team synergy between the sales engineer and the account executive, due to the fact that a consistent team is not practicing the craft together.

Conclusion

The presales matrix is a framework to provide guidance around the complex questions that pertain to presales leaders as they structure their teams. The presales industry has its share of complex challenges, and this by no means is the end all be all to solve all the problems presented to us. Experience, philosophy, reasoning and common sense will obviously need to be applied. The goal of sharing the matrix was just to provide a starting point on how I think about the questions and problems I’m trying to solve every day. Collaborating with my industry peers is a key element in building a successful presales organization. We have to understand that all our organizations have their unique nuances and these need to be understood and applied to our thought processes.

If you have any questions, comments, additional content, or want to chat about any of the topics I’ve discussed, please feel free to reach out to Provarity.